January 2025

2025 climate action for value chains and carbon markets

During my time as CEO of SustainCERT, I have had the privilege of witnessing incredible progress in the fight against climate change, but I’ve also seen the urgency for action to intensify. With just five years remaining until the critical milestone of 2030, the window to achieve meaningful emission reductions is narrowing rapidly. As we step into 2025, the urgency for credible climate action has never been greater and the coming year will be critical in shaping the pathways for companies that are intensifying their efforts to meet their climate targets.

The progress made in 2024 laid the foundation for what’s next and 2025 promises significant developments for both value chain emissions and carbon markets. In this article, I will share my perspective on the key development areas that will shape the climate action landscape in 2025, what to look out for and what's in store for SustainCERT.

Building rules in the fast-evolving Scope 3 landscape

Tackling Scope 3 emissions – those generated across a company’s value chain – has always been a complex challenge. But in 2024, efforts to harmonize standards on Scope 3 emissions gained momentum, enabling companies to take more decisive action. Major standards such as the GHG Protocol and the Science Based Targets initiative (SBTi) made significant strides in refining their Scope 3 guidelines. Both standards are undergoing revisions to their key guidance documents, and the anticipated updates to the Corporate Value Chain (Scope 3) Standard and the Corporate Net Zero Standard, expected in 2025, will provide companies with the clarity they need to act decisively.

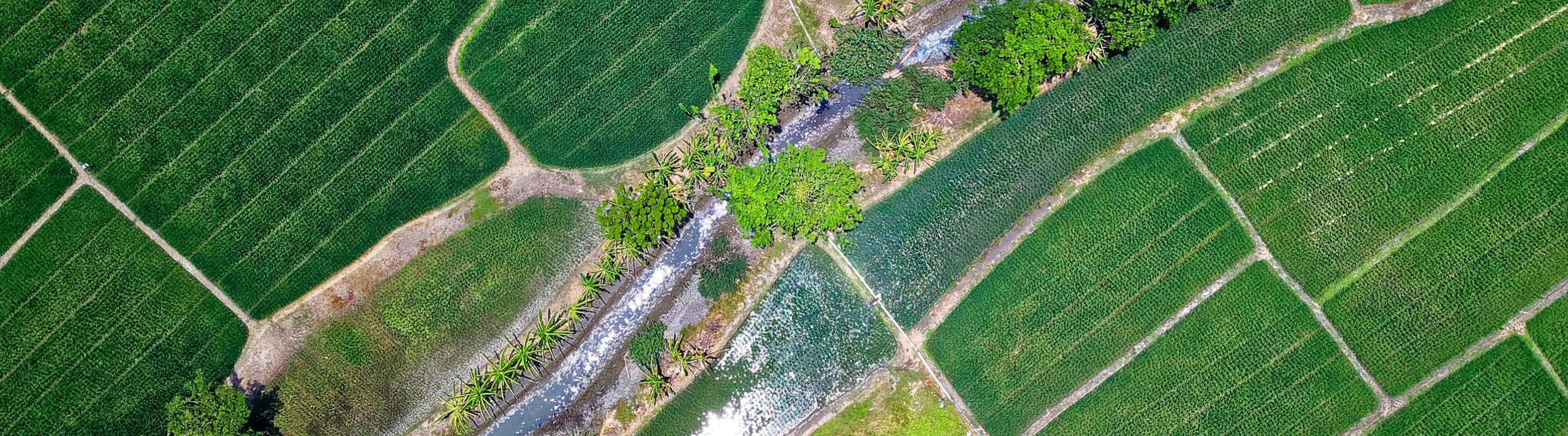

For land-intensive sectors like agriculture and forestry, the long-awaited Land Sector and Removals Guidance (LSRG) from the GHG Protocol will finally address a critical gap by offering a standardized method to account for corporate emissions. This is a development I’ve been personally following closely, and it has the potential to unlock real change in the food and agriculture sector.

The debate over how Environmental Attribute Certificates (EACs) fit into Scope 3 target-setting also captured a lot of attention last year. The SBTi discussion paper sparked considerable debate on what mechanisms should be allowed for meeting Scope 3 targets. The final rules are still under development and will be reflected in the new version of the Corporate Net Zero Standard. I expect the final guidance coming this year to be instrumental in shaping corporate Scope 3 Strategies going forward. Also worth mentioning, the SBTi released guidance on Beyond Value Chain Mitigation, opening new avenues for companies to invest in climate mitigation beyond their Scope 3 targets.

Regulatory pressure is another driver we cannot ignore. New rules under regulations such as the EU Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence Directive (CSDDD), and Green Claims are making Scope 3 disclosure mandatory for businesses. These regulations will impact value chains of companies operating within the EU, with large companies required to report their Scope 3 emissions in line with the CSRD from 2025-26. Accounting according to the Carbon Border Adjustment Mechanism (CBAM) of the EU also became mandatory as of January 1, 2025. In the United States, the California Climate Corporate Data Accountability Act, effective since late 2023, has already prompted many companies to prepare for mandatory Scope 3 disclosure. These rules are not just about compliance – they are changing the way companies think about accountability within their value chains.

Lastly, voluntary carbon market actors are starting to play a more prominent role. Verra’s upcoming Scope 3 Standard, due in 2025, is a great example of how actors across the market are stepping up to fill gaps. Our strategic partnership with Verra is a personal point of pride and represents our commitment to simplify and standardize the Scope 3 landscape. By leveraging Verra's Scope 3 Standard Program and SustainCERT's auditing experience and capabilities we are developing tools to enable companies to credibly report, track, and co-claim the impact of interventions.

Creating integrity in carbon markets

The voluntary carbon market has come a long way, but trust and transparency remain a challenge. This has led to the establishment of bodies like the Integrity Council for the Voluntary Carbon Market (ICVCM), which aims to set and maintain a global standard for high integrity. In 2024, they took a major step by publishing the first standards and methodologies eligible for their Core Carbon Principles-labeling, which set a higher bar for the quality of carbon credits. I am confident that in 2025 we will see a significant increase in the volume of CCP-labelled credits as the ICVCM continues to assess and approve more carbon standards and methodologies.

Equally important, the operationalization of Article 6 of the Paris Agreement took a significant step forward with the finalization of the rules at COP29 in Baku. This means that the market is finally moving toward a framework endorsed by governments worldwide. This development is a game changer, and it provides the clarity and direction the market has been waiting for. The implementation of Article 6 is expected to have a positive impact on carbon markets and boost demand for carbon credits.

Innovation is also a key driver of progress. Digital Monitoring, Reporting and Verification (D-MRV) is one of the most exciting advancements I see in the space. Standards such as Verra and Gold Standard are running pilots to test these solutions and set up working groups to assess how DMRV can be used to scale up carbon markets, increasing integrity and improving efficiencies. I expect 2025 will be the year these solutions start being deployed in the market. D-MRV will not only ensure credibility and integrity in the market, but it will also unlock the scale the market needs to grow and make a larger impact.

What’s in store for SustainCERT

At SustainCERT, we have always been guided by the belief that innovation and integrity go hand in hand, and as I look toward 2025, I see incredible opportunities for us to continue shaping the future of climate action.

One of our primary focuses will be scaling D-MRV. We have been pioneers in digital verification since 2018, and I am excited to see how our efforts, including leading a working group with the World Bank, will drive adoption. I expect the first issuance of carbon credits from pilots within the first half of 2025, a milestone I believe will transform the market.

We are also doubling down on the development of the SustainCERT platform, supported by our strategic partnership with TüvSüd. The Platform is designed to connect with VVBs and Standards and to leverage AI for faster issuance of high-quality credits and to unlock scale in carbon markets.

The operationalization of the Paris Agreement Crediting Mechanism will be another focus area for SustainCERT. With the first credits issued under Article 6.4 expected this year, we are preparing to support project developers across the world with our verification services.

On the corporate climate action side, we look forward to scaling our new Emission Factor verification and Impact Modeling solutions. The outcomes of the long-awaited LSRG, the updated SBTi Corporate Net Zero Standard, and Verra’s Scope 3 Standard will inform the evolution of our Rules & Requirements and guide the expansion of our offerings to help companies tackle emissions in their value chains.

Above all, collaboration remains at the heart of what we do. We will continue our partnerships with industry leaders and engaging with stakeholders to scale credible climate action and ensure companies have the tools they need to meet their climate ambitions with confidence and integrity. 2025 will be a year of transformation for climate action and carbon markets. Together, we can make meaningful progress toward a sustainable future.